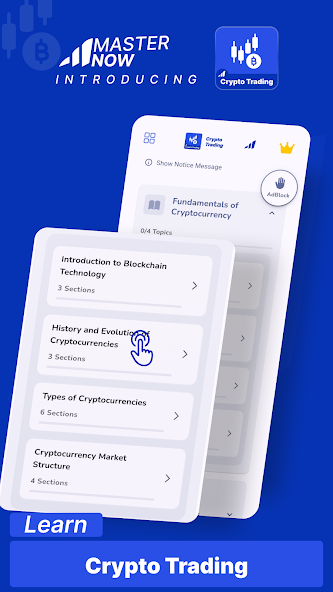

Learn cryptocurrency trading fundamentals

251

Sub Topics

722

MCQs

380

MCOs

583

True/False

320

Fill Blanks

102

Rearrange

270

Matching

152

Comprehensions

274

Flashcard Decks

Curriculum

What You'll Learn

01 Fundamentals of Cryptocurrency 4 topics

1 Introduction to Blockchain Technology

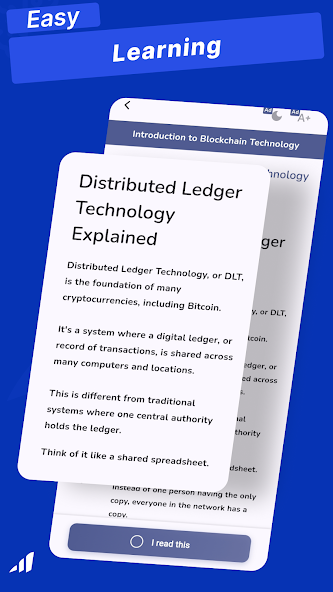

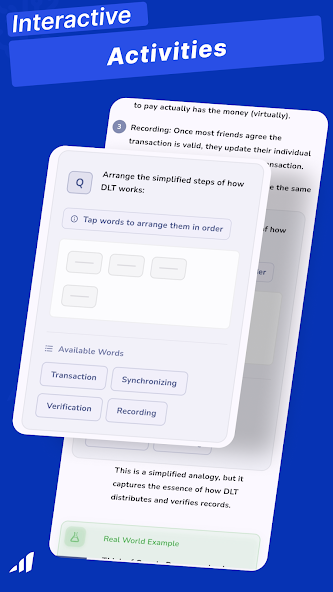

- Distributed Ledger Technology Explained

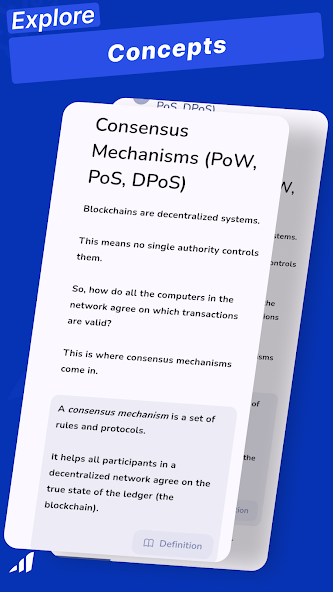

- Consensus Mechanisms (PoW, PoS, DPoS)

- Public vs Private Blockchains

2 History and Evolution of Cryptocurrencies

- The Birth of Bitcoin

- The Rise of Altcoins

- Generations of Cryptocurrency Development

3 Types of Cryptocurrencies

- Payment Cryptocurrencies (Bitcoin, Litecoin)

- Platform Tokens (Ethereum, Solana)

- Utility Tokens

- Security Tokens

- Stablecoins

- Central Bank Digital Currencies (CBDCs)

4 Cryptocurrency Market Structure

- Market Capitalization

- Liquidity Considerations

- Trading Pairs

- Market Participants

02 Cryptocurrency Exchanges and Trading Platforms 4 topics

1 Centralized Exchanges (CEX)

- Major Global Exchanges

- Account Setup and Verification

- Security Considerations

- Fee Structures

2 Decentralized Exchanges (DEX)

- How DEXs Work

- AMM vs Order Book Models

- Popular DEX Platforms

- Advantages and Limitations

3 Trading Interfaces

- Spot Trading Platforms

- Futures and Derivatives Platforms

- Mobile Trading Apps

- Advanced Trading Terminals

4 Selecting the Right Exchange

- Security Considerations

- Geographic Restrictions

- Asset Availability

- Trading Fees and Volumes

03 Getting Started with Crypto Trading 4 topics

1 Setting Up Trading Accounts

- KYC/AML Requirements

- Two-Factor Authentication

- API Keys and Security

2 Cryptocurrency Wallets

- Hot vs Cold Storage

- Types of Wallets (Hardware, Software, Paper)

- Wallet Security Best Practices

- Multi-signature Wallets

3 Funding Your Trading Account

- Fiat On-ramps

- Crypto Transfers

- Payment Methods

- Deposit and Withdrawal Fees

4 Trading Basics

- Reading Market Data

- Understanding Order Books

- Types of Orders (Market, Limit, Stop)

- Bid-Ask Spread

04 Market Analysis Frameworks 4 topics

1 Fundamental Analysis

- Project Evaluation Criteria

- Team Assessment

- Tokenomics Analysis

- Use Case and Value Proposition

- Community and Network Effects

2 Technical Analysis Basics

- Chart Types and Timeframes

- Support and Resistance Levels

- Trend Lines and Channels

- Moving Averages

- Volume Analysis

3 Advanced Technical Indicators

- Oscillators (RSI, MACD, Stochastic)

- Bollinger Bands

- Fibonacci Retracement

- Ichimoku Cloud

- Elliott Wave Theory

4 On-Chain Analysis

- Blockchain Data Analytics

- Network Health Metrics

- Wallet Distribution Analysis

- Transaction Volume and Velocity

- HODL Waves and Age Analysis

05 Trading Strategies 4 topics

1 Day Trading Strategies

- Scalping Techniques

- Momentum Trading

- Range Trading

- News-Based Trading

- Arbitrage Opportunities

2 Swing Trading Approaches

- Trend Following

- Counter-Trend Strategies

- Breakout Trading

- Pullback Strategies

- Multi-Timeframe Analysis

3 Position Trading Methodologies

- Long-Term Trend Identification

- Fundamental-Based Positioning

- Cost Averaging Strategies

- Threshold Rebalancing

4 Algorithmic Trading

- Strategy Automation Basics

- Trading Bots Framework

- API Integration

- Backtesting Methods

- Strategy Optimization

06 Risk Management and Psychology 4 topics

1 Risk Management Fundamentals

- Position Sizing Techniques

- Setting Stop Losses

- Take Profit Strategies

- Risk-Reward Ratios

- Portfolio Allocation Models

2 Advanced Risk Management

- Kelly Criterion

- Value at Risk (VaR)

- Correlation Analysis

- Hedging Strategies

- Stress Testing

3 Trading Psychology

- Common Psychological Biases

- Emotional Management

- Maintaining Trading Discipline

- Developing a Trading Mindset

- Handling Losses and Wins

4 Creating and Following a Trading Plan

- Defining Trading Goals

- Strategy Documentation

- Performance Metrics

- Journal Keeping

- Plan Revision Process

07 Derivatives and Advanced Products 4 topics

1 Futures Trading

- Perpetual Futures Explained

- Funding Rates

- Liquidation Mechanics

- Basis Trading

2 Options Strategies

- Call and Put Options

- Options Pricing Models

- Volatility Trading

- Complex Options Strategies

- Greeks Explained

3 Leveraged Trading

- Margin Trading Mechanics

- Cross vs Isolated Margin

- Leverage Risk Management

- Liquidation Prevention

4 Structured Products

- Yield-Generating Products

- Dual Currency Investments

- Crypto ETPs and ETFs

- Staking as a Service

08 DeFi Trading Strategies 4 topics

1 DeFi Fundamentals

- Smart Contracts and Protocols

- TVL and Protocol Metrics

- Yield Farming Mechanics

- Impermanent Loss Explained

2 Liquidity Provision Strategies

- AMM LP Tactics

- Range Order Strategies

- Concentrated Liquidity Management

- Protocol Incentives Optimization

3 Yield Optimization

- Lending Platforms Strategies

- Yield Aggregators

- Leveraged Yield Farming

- Risk Assessment in DeFi

4 DeFi Derivatives

- Synthetic Assets

- Perpetual Swap Protocols

- Options Vaults

- Cross-Chain Derivative Strategies

09 Market Cycles and Macro Analysis 4 topics

1 Cryptocurrency Market Cycles

- Historical Cycle Analysis

- Bitcoin Halving Effects

- Altcoin Season Patterns

- Cycle Identification Methods

2 Correlation with Traditional Markets

- Crypto-Equity Correlations

- Bitcoin as Digital Gold Thesis

- Inflation and Monetary Policy Effects

- Risk-on/Risk-off Dynamics

3 On-Chain Cycle Indicators

- UTXO Age Distribution

- Realized Value Metrics

- Exchange Flow Analysis

- Miner Behavior Patterns

4 Global Macro Factors

- Regulatory Developments

- Institutional Adoption Trends

- Currency Devaluation Effects

- Geopolitical Impact Factors

10 Portfolio Management for Crypto Traders 4 topics

1 Portfolio Construction

- Asset Allocation Models

- Correlation-Based Diversification

- Market Cap Weighting Strategies

- Risk-Adjusted Return Optimization

2 Rebalancing Strategies

- Periodic Rebalancing

- Threshold Rebalancing

- Volatility-Based Rebalancing

- Tax-Efficient Rebalancing

3 Performance Tracking

- Calculating Returns (ROI, CAGR)

- Risk-Adjusted Metrics (Sharpe, Sortino)

- Drawdown Analysis

- Benchmarking Methods

4 Tax Management

- Tax Reporting Requirements

- Tax-Loss Harvesting

- Accounting Methods (FIFO, LIFO)

- Cross-Border Tax Considerations

11 Tools and Resources for Traders 4 topics

1 Analytics Platforms

- Market Data Aggregators

- Technical Analysis Tools

- On-Chain Analytics Dashboards

- Portfolio Trackers

2 Research Resources

- Quality Information Sources

- Research Methodology

- Due Diligence Frameworks

- Community Intelligence

3 Trading Tools

- Trading Terminal Solutions

- Backtesting Software

- Strategy Automation Tools

- Alert Systems

4 Risk Management Tools

- Position Calculators

- Portfolio Correlation Tools

- Volatility Analysis Tools

- Simulation Software

12 Regulatory and Security Considerations 4 topics

1 Global Regulatory Landscape

- Major Jurisdictional Approaches

- Compliance Requirements

- Travel Rule and FATF Guidelines

- Future Regulatory Trends

2 Security Best Practices

- Exchange Security Assessment

- Personal OpSec Guidelines

- Cold Storage Implementation

- Secure Communication Methods

3 Avoiding Scams and Fraud

- Common Scam Typologies

- Red Flags Identification

- Due Diligence Process

- Verification Techniques

4 Tax Compliance

- Record-Keeping Requirements

- Tax Reporting Software

- Working with Crypto Tax Professionals

- International Tax Considerations

13 Advanced Market Concepts 4 topics

1 Market Microstructure

- Orderbook Dynamics

- Liquidity Profiles

- Market Making Mechanics

- High-Frequency Trading Impact

2 Market Efficiency

- Efficient Market Hypothesis in Crypto

- Information Asymmetry

- Market Anomalies

- Alpha Generation Concepts

3 Volatility Analysis

- Historical vs. Implied Volatility

- Volatility Regimes

- Volatility Surface Understanding

- Volatility-Based Trading Strategies

4 Market Manipulation

- Common Manipulation Tactics

- Wash Trading Detection

- Pump and Dump Schemes

- Front-Running in DeFi

14 Professional Trading Development 4 topics

1 Building a Trading Business

- Legal Structure Considerations

- Capital Raising Strategies

- Operational Infrastructure

- Risk Management Framework

2 Developing Trading Systems

- System Design Principles

- Systematic vs. Discretionary Approaches

- Execution Algorithms

- Performance Evaluation

3 Career Paths in Crypto Trading

- Prop Trading Opportunities

- Hedge Fund Structures

- Market Making Businesses

- Trading Education and Consulting

4 Continuous Improvement

- Performance Review Process

- Adapting to Market Evolution

- Skill Development Framework

- Community and Mentorship

15 Emerging Trends and Future of Crypto Trading 4 topics

1 Institutional Market Evolution

- Prime Brokerage Development

- Institutional Custody Solutions

- ETF and Regulated Products

- Traditional Finance Integration

2 Technological Innovations

- Layer 2 Trading Solutions

- Cross-Chain Trading Infrastructure

- Privacy-Preserving Trading

- AI and ML in Trading Strategies

3 Regulatory Evolution

- CBDC Impact on Crypto Markets

- Global Regulatory Harmonization

- DeFi Regulation Approaches

- Self-Regulation Initiatives

4 Future Market Dynamics

- Market Maturation Projections

- Liquidity Evolution

- New Asset Classes

- Decentralized Trading Infrastructure

Explore More

Crypto Trading

Get it on Google Play