"very good easy to use."

241

Sub Topics

695

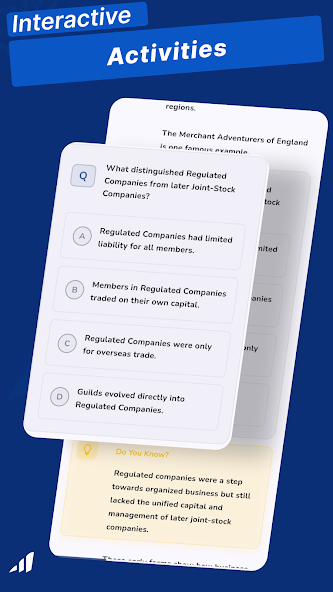

MCQs

377

MCOs

542

True/False

322

Fill Blanks

110

Rearrange

273

Matching

155

Comprehensions

281

Flashcard Decks

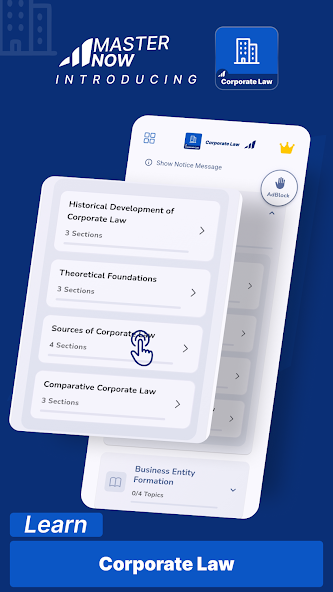

Curriculum

What You'll Learn

01 Introduction to Corporate Law 4 topics

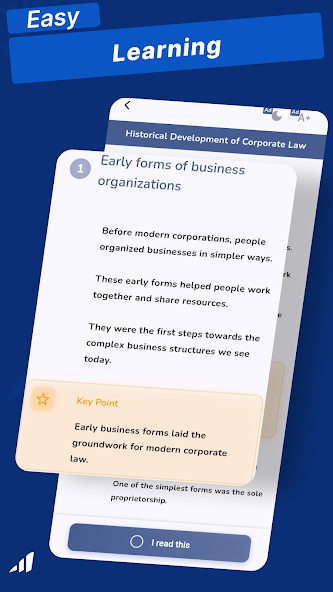

1 Historical Development of Corporate Law

- Early forms of business organizations

- Evolution of the modern corporation

- Key developments in corporate law history

2 Theoretical Foundations

- The corporation as a legal entity

- Theories of corporate personhood

- Economic theories of the firm

3 Sources of Corporate Law

- Statutory law

- Case law

- Regulatory frameworks

- International sources

4 Comparative Corporate Law

- Common law jurisdictions

- Civil law jurisdictions

- Mixed systems

02 Business Entity Formation 4 topics

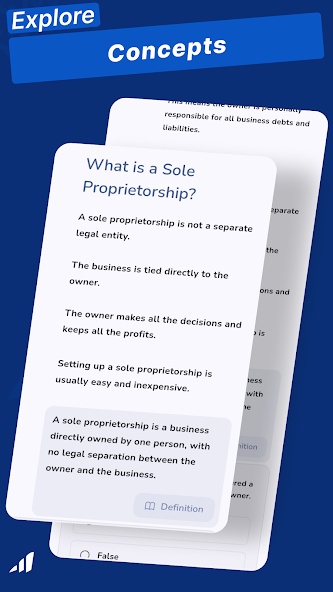

1 Types of Business Organizations

- Sole proprietorships

- Partnerships (general and limited)

- Limited liability companies (LLCs)

- Corporations (C and S corporations)

- Benefit corporations and social enterprises

2 Incorporation Process

- Pre-incorporation considerations

- Articles of incorporation

- Corporate bylaws

- Initial organizational meetings

- Post-incorporation formalities

3 Corporate Naming and Identity

- Name selection and restrictions

- Trademarks and corporate identity

- Domain names and digital presence

4 Jurisdictional Considerations

- Domestic incorporation

- Foreign incorporation

- Delaware advantage

- Tax considerations in jurisdiction selection

03 Corporate Governance 4 topics

1 Board of Directors

- Composition and structure

- Qualifications and selection

- Term limits and removal

- Board committees

2 Corporate Officers

- Appointment and authority

- Duties and responsibilities

- Relationship with board of directors

3 Shareholders

- Rights and powers

- Meetings and voting

- Proxy processes

- Shareholder proposals

- Shareholder activism

4 Governance Documents

- Corporate charters

- Bylaws

- Governance guidelines

- Codes of conduct

- Ethics policies

04 Fiduciary Duties 4 topics

1 Duty of Care

- Standard of conduct

- Business judgment rule

- Decision-making processes

- Oversight responsibilities

2 Duty of Loyalty

- Conflicts of interest

- Corporate opportunities

- Self-dealing transactions

- Competing with the corporation

3 Duty of Good Faith

- Definition and scope

- Intersection with other duties

- Bad faith conduct

4 Duties in Special Circumstances

- Mergers and acquisitions

- Hostile takeovers

- Insolvency

- Closely held corporations

05 Corporate Finance 4 topics

1 Capital Structure

- Equity financing

- Debt financing

- Hybrid securities

- Capital maintenance rules

2 Securities Issuance

- Common stock

- Preferred stock

- Corporate bonds

- Private placements

- Initial public offerings

3 Dividends and Distributions

- Dividend policies

- Legal restrictions on distributions

- Stock dividends and splits

- Share repurchases

4 Corporate Valuation

- Valuation methods

- Book value vs. market value

- Goodwill and intangible assets

06 Securities Regulation 4 topics

1 Securities Laws Framework

- Securities Act of 1933

- Securities Exchange Act of 1934

- State "blue sky" laws

- International securities regulation

2 Registration and Exemptions

- Registration process

- Exempt offerings

- Private placements

- Regulation D

- Crowdfunding

3 Disclosure Requirements

- Periodic reporting (10-K, 10-Q, 8-K)

- Proxy statements

- Executive compensation disclosure

- Environmental, social, and governance (ESG) disclosures

4 Insider Trading and Market Manipulation

- Prohibited practices

- Rule 10b-5

- Safe harbors

- Penalties and enforcement

07 Mergers and Acquisitions 4 topics

1 Transaction Structures

- Mergers

- Stock acquisitions

- Asset acquisitions

- Tender offers

- Leveraged buyouts

2 Deal Process

- Target identification and valuation

- Due diligence

- Negotiation strategies

- Documentation

- Closing

3 Legal and Regulatory Considerations

- Antitrust review

- Securities law compliance

- Foreign investment review

- Industry-specific regulations

4 Defensive Strategies

- Poison pills

- Staggered boards

- White knights

- Crown jewel defenses

- Golden parachutes

08 Corporate Restructuring and Dissolution 4 topics

1 Reorganization

- Voluntary restructuring

- Chapter 11 bankruptcy

- Debt restructuring

- Business spin-offs

2 Liquidation

- Voluntary dissolution

- Involuntary dissolution

- Chapter 7 bankruptcy

- Asset distribution

3 Corporate Wind-Down

- Legal requirements

- Tax considerations

- Employee considerations

- Records retention

4 Business Revival

- Reinstatement procedures

- Successor liability

- Assignment for benefit of creditors

09 Corporate Litigation 4 topics

1 Shareholder Litigation

- Direct suits

- Derivative actions

- Class actions

- Demand requirements

2 Corporate Internal Investigations

- Triggering events

- Process and procedures

- Attorney-client privilege issues

- Reporting obligations

3 Alternative Dispute Resolution

- Arbitration

- Mediation

- Negotiated settlements

- Forum selection clauses

4 Indemnification and Insurance

- Director and officer indemnification

- Advancement of expenses

- D&O insurance

- Indemnification limitations

10 Corporate Compliance and Risk Management 4 topics

1 Compliance Programs

- Program design and implementation

- Risk assessment

- Training and education

- Monitoring and auditing

- Response and prevention

2 Corporate Criminal Liability

- Respondeat superior doctrine

- Corporate prosecution guidelines

- Deferred prosecution agreements

- Non-prosecution agreements

3 Anti-Corruption Compliance

- Foreign Corrupt Practices Act (FCPA)

- UK Bribery Act

- OECD Anti-Bribery Convention

- Facilitation payments

4 Whistleblower Protection

- Statutory protections

- Internal reporting systems

- Retaliation claims

- Bounty programs

11 International Corporate Law 4 topics

1 Multinational Corporations

- Cross-border operations

- Parent-subsidiary relationships

- Branch offices and subsidiaries

- Agency relationships

2 International Corporate Governance

- OECD principles

- Country-specific governance codes

- Convergence vs. divergence

3 Cross-Border Transactions

- International mergers and acquisitions

- Joint ventures

- Technology transfers

- Foreign direct investment

4 Treaty-Based Protections

- Bilateral investment treaties

- Free trade agreements

- Dispute resolution mechanisms

- Sovereign immunity issues

12 Corporate Social Responsibility and ESG 4 topics

1 Legal Frameworks for CSR

- Mandatory vs. voluntary approaches

- Benefit corporation statutes

- Corporate purpose clauses

- Stakeholder statutes

2 Environmental Obligations

- Environmental compliance

- Climate change disclosure

- Sustainability reporting

- Environmental justice

3 Social Considerations

- Labor and employment standards

- Human rights due diligence

- Supply chain management

- Community relations

4 Governance Best Practices

- Board diversity

- Executive compensation

- Shareholder engagement

- Ethical business practices

13 Technology and Corporate Law 4 topics

1 Digital Governance

- Virtual shareholder meetings

- Electronic voting

- Digital signatures

- Records management

2 Cybersecurity and Data Privacy

- Legal obligations

- Board oversight responsibilities

- Breach response planning

- Cross-border data transfers

3 Emerging Business Models

- Platform companies

- Sharing economy

- Fintech innovations

- Decentralized autonomous organizations

4 Blockchain and Smart Contracts

- Distributed ledger technology

- Smart contract enforcement

- Tokenization of assets

- Regulatory challenges

14 Corporate Taxation 4 topics

1 Corporate Tax Structures

- C corporation taxation

- S corporation taxation

- LLC taxation options

- Partnership taxation

2 Tax Planning Strategies

- Entity selection considerations

- Capital structure optimization

- Compensation planning

- Deduction maximization

3 International Tax Considerations

- Transfer pricing

- Controlled foreign corporations

- Base erosion and profit shifting

- Tax treaties

4 Tax Compliance

- Filing requirements

- Tax accounting methods

- Estimated tax payments

- Tax controversy management

15 Special Industry Regulations 4 topics

1 Financial Institutions

- Banking regulations

- Securities firms

- Insurance companies

- Investment advisors

2 Healthcare Organizations

- Provider entities

- Pharmaceutical companies

- Medical device manufacturers

- Healthcare IT

3 Energy Companies

- Oil and gas

- Utilities

- Renewable energy

- Nuclear power

4 Technology and Communications

- Telecommunications

- Software and internet

- Social media platforms

- Cloud services

Explore More

Corporate Law

Get it on Google Play