Master corporate finance and investment decisions

196

Sub Topics

624

MCQs

310

MCOs

458

True/False

218

Fill Blanks

91

Rearrange

230

Matching

123

Comprehensions

223

Flashcard Decks

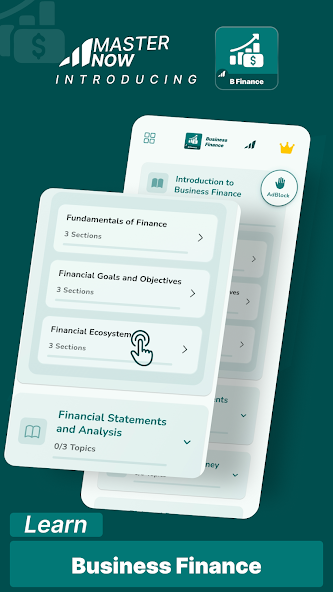

Curriculum

What You'll Learn

01 Introduction to Business Finance 3 topics

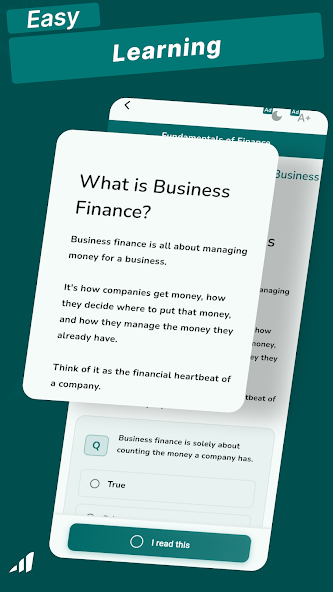

1 Fundamentals of Finance

- Definition and Scope of Business Finance

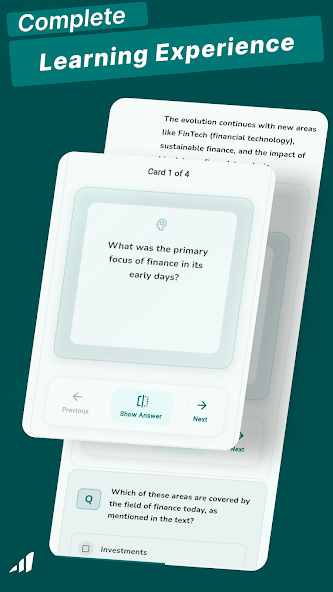

- Evolution of Finance as a Discipline

- Finance Function in Modern Organizations

2 Financial Goals and Objectives

- Profit Maximization vs Wealth Maximization

- Stakeholder Value Creation

- Corporate Social Responsibility and Finance

3 Financial Ecosystem

- Financial Markets and Institutions

- Financial Intermediaries

- Regulatory Environment

02 Financial Statements and Analysis 3 topics

1 Basic Financial Statements

- Balance Sheet

- Income Statement

- Cash Flow Statement

- Statement of Changes in Equity

2 Financial Statement Analysis

- Horizontal and Vertical Analysis

- Ratio Analysis (Liquidity, Profitability, Efficiency, Leverage)

- DuPont Analysis

- Limitations of Financial Statement Analysis

3 Advanced Financial Analysis

- Cash Flow Analysis

- Economic Value Added (EVA)

- Market Value Added (MVA)

- Bankruptcy Prediction Models

03 Time Value of Money 3 topics

1 Basic Concepts

- Present Value and Future Value

- Simple vs Compound Interest

- Nominal vs Effective Interest Rates

2 Annuities and Perpetuities

- Ordinary Annuities

- Annuities Due

- Growing Annuities

- Perpetuities

3 Applications in Finance

- Loan Amortization

- Bond Valuation

- Retirement Planning

- Capital Budgeting Applications

04 Risk and Return 3 topics

1 Understanding Risk

- Types of Financial Risk

- Risk Measurement

- Risk-Return Relationship

2 Portfolio Theory

- Diversification Principles

- Modern Portfolio Theory

- Efficient Frontier

- Capital Market Line

3 Asset Pricing Models

- Capital Asset Pricing Model (CAPM)

- Arbitrage Pricing Theory (APT)

- Factor Models

- Behavioral Finance Perspectives

05 Capital Budgeting 3 topics

1 Investment Evaluation Methods

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Modified Internal Rate of Return (MIRR)

- Payback Period

- Profitability Index

2 Capital Budgeting Process

- Project Identification and Screening

- Cash Flow Estimation

- Risk Analysis in Capital Budgeting

- Post-Implementation Review

3 Special Issues in Capital Budgeting

- Capital Rationing

- Mutually Exclusive Projects

- Replacement Decisions

- International Capital Budgeting

06 Cost of Capital and Capital Structure 3 topics

1 Components of Capital Cost

- Cost of Debt

- Cost of Preferred Stock

- Cost of Common Equity

- Weighted Average Cost of Capital (WACC)

2 Capital Structure Decisions

- Optimal Capital Structure

- Modigliani-Miller Propositions

- Trade-off Theory

- Pecking Order Theory

3 Leverage Analysis

- Operating Leverage

- Financial Leverage

- Combined Leverage

- Leverage and Business Risk

07 Working Capital Management 5 topics

1 Working Capital Fundamentals

- Components of Working Capital

- Operating Cycle

- Working Capital Policies

- Determinants of Working Capital

2 Cash and Marketable Securities Management

- Cash Budget

- Cash Management Models

- Cash Collection and Disbursement Systems

- Short-term Investment Strategies

3 Inventory Management

- Economic Order Quantity (EOQ)

- Just-in-Time Systems

- ABC Analysis

- Inventory Valuation Methods

4 Accounts Receivable Management

- Credit Policy

- Credit Evaluation and Scoring

- Collection Policies

- Factoring and Trade Discounts

5 Short-term Financing

- Trade Credit

- Bank Credit

- Commercial Paper

- Inventory Financing

08 Long-term Financing 3 topics

1 Equity Financing

- Common Stock

- Preferred Stock

- Private Equity

- Venture Capital

2 Debt Financing

- Term Loans

- Bonds

- Debentures

- Lease Financing

3 Hybrid Financing Instruments

- Convertible Securities

- Warrants

- Options

- Structured Finance Products

09 Dividend Policy 3 topics

1 Dividend Fundamentals

- Types of Dividends

- Dividend Theories

- Dividend Irrelevance Theory

- Bird-in-the-Hand Theory

2 Dividend Policies

- Stable Dividend Policy

- Constant Payout Ratio

- Residual Dividend Policy

- Progressive Dividend Policy

3 Strategic Dividend Decisions

- Share Repurchases

- Stock Splits and Stock Dividends

- Dividend Reinvestment Plans

- Tax Considerations in Dividend Policy

10 Mergers, Acquisitions, and Corporate Restructuring 3 topics

1 Merger and Acquisition Fundamentals

- Types of Mergers and Acquisitions

- Valuation in M&A

- Synergy Analysis

- Deal Structuring

2 Corporate Restructuring Strategies

- Spin-offs

- Carve-outs

- Split-ups

- Divestitures

3 Financial Distress and Reorganization

- Causes of Financial Distress

- Bankruptcy Procedures

- Reorganization vs Liquidation

- Workout Arrangements

11 International Financial Management 3 topics

1 International Financial Environment

- Exchange Rate Systems

- Balance of Payments

- International Financial Markets

- Global Financial Institutions

2 Foreign Exchange Risk Management

- Transaction Exposure

- Translation Exposure

- Economic Exposure

- Hedging Strategies

3 International Investment and Financing

- Foreign Direct Investment

- International Portfolio Investment

- International Capital Budgeting

- Multinational Capital Structure

12 Financial Planning and Forecasting 3 topics

1 Financial Planning Process

- Strategic Planning

- Long-term Financial Planning

- Short-term Financial Planning

- Sustainable Growth Rate

2 Financial Forecasting Methods

- Percentage of Sales Method

- Regression Analysis

- Time Series Analysis

- Monte Carlo Simulation

3 Financial Modelling

- Integrated Financial Statements

- Scenario Analysis

- Sensitivity Analysis

- Simulation Models

13 Risk Management 3 topics

1 Enterprise Risk Management

- Risk Identification

- Risk Measurement

- Risk Mitigation Strategies

- Risk Governance

2 Financial Risk Management

- Interest Rate Risk

- Currency Risk

- Commodity Price Risk

- Credit Risk

3 Derivatives and Hedging

- Forward and Futures Contracts

- Options and Swaps

- Credit Derivatives

- Structured Products

14 Valuation 3 topics

1 Business Valuation Approaches

- Asset-Based Valuation

- Income-Based Valuation

- Market-Based Valuation

- Option-Based Valuation

2 Valuation Models

- Discounted Cash Flow (DCF) Models

- Relative Valuation Models

- Economic Profit Models

- Real Options Valuation

3 Special Valuation Situations

- Private Company Valuation

- Startup Valuation

- Distressed Company Valuation

- Intangible Asset Valuation

15 Financial Technology and Innovation 3 topics

1 Financial Technology Evolution

- Digital Banking

- Payment Systems

- Blockchain and Cryptocurrencies

- Artificial Intelligence in Finance

2 Financial Innovation

- Fintech Business Models

- Peer-to-Peer Lending

- Crowdfunding

- Robo-Advisors

3 Digital Finance Transformation

- Data Analytics in Finance

- Automation of Financial Processes

- Cybersecurity in Finance

- Regulatory Technology (RegTech)

16 Ethical and Professional Standards in Finance 3 topics

1 Financial Ethics

- Ethical Frameworks in Finance

- Conflict of Interest

- Fiduciary Responsibility

- Whistle-Blowing

2 Corporate Governance

- Board Structure and Responsibilities

- Executive Compensation

- Shareholder Rights

- Corporate Governance Codes

3 Professional Standards

- CFA Institute Code of Ethics

- Financial Certification Standards

- Professional Liability

- Ethics in Investment Management

Explore More

Business Finance

Get it on Google Play