"All this app that you have putted on your ads here have no complain. they really interesting 🤔"

150

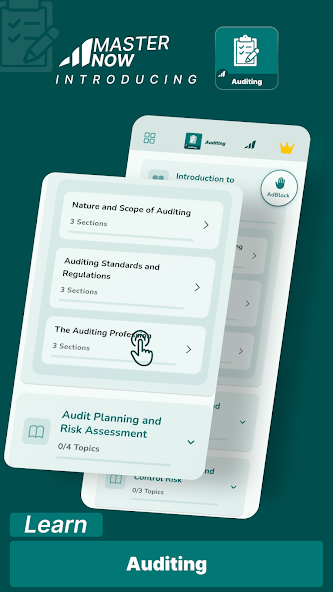

Sub Topics

452

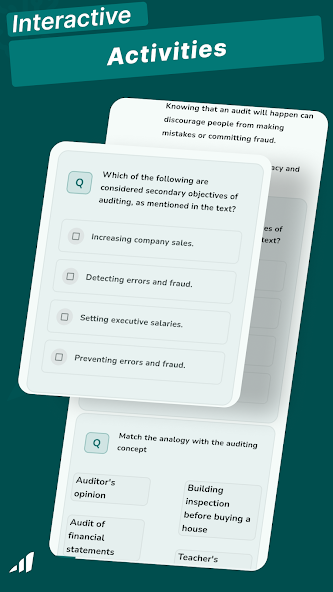

MCQs

248

MCOs

348

True/False

198

Fill Blanks

70

Rearrange

172

Matching

82

Comprehensions

186

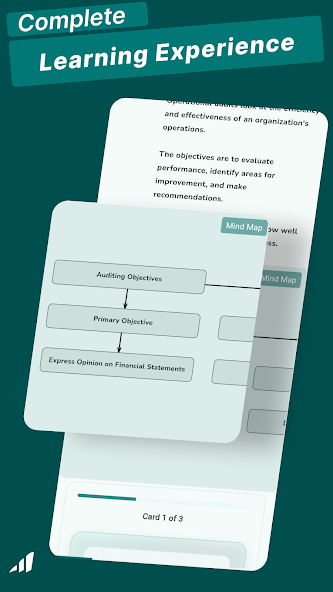

Flashcard Decks

Curriculum

What You'll Learn

01 Introduction to Auditing 3 topics

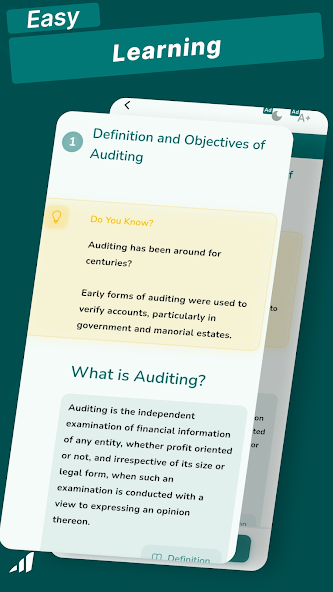

1 Nature and Scope of Auditing

- Definition and Objectives of Auditing

- Evolution of Auditing

- Types of Audits (Financial, Compliance, Operational, etc.)

2 Auditing Standards and Regulations

- International Standards on Auditing (ISAs)

- Generally Accepted Auditing Standards (GAAS)

- Regulatory Framework

3 The Auditing Profession

- Professional Ethics and Responsibilities

- Role of Professional Bodies

- Legal Liability of Auditors

02 Audit Planning and Risk Assessment 4 topics

1 Understanding the Entity and Its Environment

- Industry Analysis

- Business Operations and Strategy

- Organizational Structure

2 Materiality in Auditing

- Concept and Determination of Materiality

- Performance Materiality

- Revision of Materiality

3 Risk Assessment Procedures

- Identifying and Assessing Risks of Material Misstatement

- Business Risk Approach

- Fraud Risk Assessment

4 Audit Strategy and Audit Plan

- Developing the Overall Audit Strategy

- Preparing the Audit Plan

- Resource Allocation and Timing

03 Internal Control and Control Risk 3 topics

1 Internal Control Systems

- Components of Internal Control (COSO Framework)

- Control Environment

- Risk Assessment Process

2 Evaluation of Internal Controls

- Testing of Controls

- Identification of Control Deficiencies

- Reporting on Internal Control

3 IT Controls and Audit

- General IT Controls

- Application Controls

- Computer-Assisted Audit Techniques (CAATs)

04 Audit Evidence and Documentation 3 topics

1 Nature and Sources of Audit Evidence

- Types of Audit Evidence

- Reliability and Sufficiency of Evidence

- Techniques for Gathering Evidence

2 Audit Sampling

- Statistical and Non-Statistical Sampling

- Sample Design and Selection

- Evaluation of Sample Results

3 Audit Documentation

- Working Papers

- Documentation Requirements

- Review and Retention of Audit Files

05 Substantive Testing – Assets 4 topics

1 Cash and Cash Equivalents

- Bank Reconciliation Procedures

- Cash Counts

- Confirmation of Bank Balances

2 Accounts Receivable and Revenue

- Confirmation Procedures

- Allowance for Doubtful Accounts

- Cutoff Testing

3 Inventory and Cost of Goods Sold

- Physical Inventory Observation

- Cost Validation

- Valuation Testing

4 Property, Plant, and Equipment

- Verification of Additions and Disposals

- Depreciation Review

- Impairment Testing

06 Substantive Testing – Liabilities and Equity 4 topics

1 Accounts Payable and Expenses

- Vendor Confirmations

- Search for Unrecorded Liabilities

- Expense Analysis

2 Debt and Borrowings

- Loan Confirmation

- Debt Covenant Compliance

- Interest Expense Testing

3 Provisions and Contingencies

- Litigation Review

- Warranty Obligations

- Environmental Liabilities

4 Shareholders' Equity

- Capital Stock Transactions

- Dividend Distributions

- Equity-Based Compensation

07 Auditing in Specialized Areas 4 topics

1 Group Audits

- Component Auditor Considerations

- Consolidation Process Review

- Inter-company Transactions

2 Related Party Transactions

- Identification of Related Parties

- Testing Related Party Transactions

- Disclosure Requirements

3 Accounting Estimates

- Management's Process Review

- Reasonableness Testing

- Sensitivity Analysis

4 Fair Value Measurements

- Valuation Methods Evaluation

- Management Assumptions Testing

- Disclosure Adequacy Assessment

08 Completing the Audit 3 topics

1 Subsequent Events

- Types of Subsequent Events

- Audit Procedures for Subsequent Events

- Disclosure Requirements

2 Going Concern Assessment

- Indicators of Going Concern Issues

- Management's Plans Evaluation

- Reporting Implications

3 Evaluating Audit Findings

- Misstatement Evaluation

- Communication with Those Charged with Governance

- Management Representations

09 Audit Reports and Communication 4 topics

1 Standard Audit Reports

- Unmodified Opinion

- Elements of the Auditor's Report

- Report Dating

2 Modified Audit Opinions

- Qualified Opinion

- Adverse Opinion

- Disclaimer of Opinion

3 Emphasis of Matter and Other Matter Paragraphs

- Circumstances Requiring Emphasis

- Presentation in the Audit Report

- Impact on the Audit Opinion

4 Key Audit Matters

- Determination of Key Audit Matters

- Communication in the Auditor's Report

- Relationship with Modified Opinions

10 Quality Control and Ethics 3 topics

1 Quality Control for Audit Firms

- Elements of Quality Control

- Engagement Quality Control Review

- Monitoring Activities

2 Ethical Requirements

- Independence

- Objectivity

- Confidentiality

3 Responding to Non-Compliance with Laws and Regulations

- Identification of Non-Compliance

- Communication with Management and Those Charged with Governance

- Reporting to Regulatory Authorities

11 Fraud and Forensic Auditing 3 topics

1 Fraud Detection and Prevention

- Fraud Triangle and Fraud Risk Factors

- Fraud Risk Assessment

- Anti-Fraud Controls

2 Forensic Auditing Techniques

- Document Examination

- Digital Forensics

- Interviewing Techniques

3 Reporting on Fraud

- Legal Considerations

- Communication with Stakeholders

- Expert Witness Testimony

12 Internal Auditing 3 topics

1 Role and Responsibilities of Internal Auditors

- Scope of Internal Audit Work

- Relationship with External Auditors

- Organizational Independence

2 Internal Audit Process

- Risk-Based Internal Auditing

- Engagement Planning and Execution

- Reporting and Follow-up

3 Evaluating Internal Audit Function

- Competence and Due Professional Care

- Quality Assurance and Improvement Program

- Conformance with Standards

13 Contemporary Issues in Auditing 3 topics

1 Impact of Technology on Auditing

- Blockchain and Distributed Ledger Technology

- Artificial Intelligence and Machine Learning

- Data Analytics in Auditing

2 Sustainability and ESG Auditing

- Environmental Audits

- Social Responsibility Assurance

- Governance Review

3 Integrated Reporting Assurance

- Framework for Integrated Reporting

- Challenges in Providing Assurance

- Future Developments

14 Public Sector Auditing 3 topics

1 Government Auditing Standards

- Compliance with Laws and Regulations

- Performance Auditing

- Attestation Engagements

2 Role of Supreme Audit Institutions

- Mandate and Authority

- Relationship with Legislature

- Public Accountability

3 Specialized Areas in Government Auditing

- Grant Audits

- Program Audits

- Budget Execution Audits

15 International Aspects of Auditing 3 topics

1 International Audit Practices

- Cultural Differences

- Regulatory Divergence

- International Standards Adoption

2 Transnational Audits

- Cross-Border Considerations

- Multi-Jurisdiction Compliance

- Group Audit Challenges

3 Global Audit Regulation

- International Forum of Independent Audit Regulators (IFIAR)

- Cooperation between Regulators

- Convergence Initiatives

Explore More

Auditing

Get it on Google Play