"This good for Accounting knowledge."

"good in learning"

"in my opinion it is the best app"

"always fun to study new skill sets.thankyou for the new app. I'll explore more when I have time."

"Best app ever"

243

Sub Topics

699

MCQs

317

MCOs

556

True/False

275

Fill Blanks

113

Rearrange

266

Matching

131

Comprehensions

247

Flashcard Decks

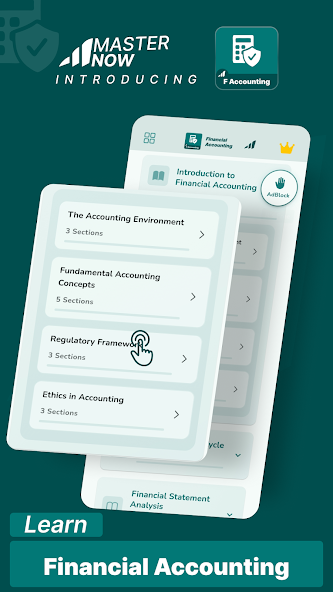

Curriculum

What You'll Learn

01 Introduction to Financial Accounting 4 topics

1 The Accounting Environment

- Role of Accounting in Business

- Users of Accounting Information

- Accounting as an Information System

2 Fundamental Accounting Concepts

- The Accounting Equation

- Business Entity Concept

- Going Concern Concept

- Monetary Unit Concept

- Time Period Concept

3 Regulatory Framework

- Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

- Standard Setting Bodies

4 Ethics in Accounting

- Code of Professional Conduct

- Ethical Dilemmas in Accounting

- Corporate Governance

02 The Accounting Cycle 6 topics

1 Accounting Transactions

- Types of Business Transactions

- Source Documents

- Transaction Analysis

2 The Recording Process

- Double-Entry Accounting System

- Debit and Credit Rules

- Journalizing Transactions

- The General Journal

3 The Ledger System

- Posting to Ledger Accounts

- Trial Balance Preparation

- Identifying and Correcting Trial Balance Errors

4 Adjusting Entries

- Accruals (Revenues and Expenses)

- Deferrals (Prepaid Expenses and Unearned Revenues)

- Depreciation

- Inventory Adjustments

5 Financial Statement Preparation

- Income Statement

- Statement of Changes in Equity

- Balance Sheet

- Cash Flow Statement

6 Closing Process

- Temporary and Permanent Accounts

- Closing Entries

- Post-Closing Trial Balance

- Accounting Cycle Summary

03 Financial Statement Analysis 4 topics

1 Purpose and Methods of Financial Analysis

- Horizontal Analysis

- Vertical Analysis

- Trend Analysis

2 Ratio Analysis

- Liquidity Ratios

- Profitability Ratios

- Activity Ratios

- Solvency Ratios

- Market Prospect Ratios

3 Comprehensive Analysis

- DuPont Analysis

- Limitations of Ratio Analysis

- Industry Comparisons

4 Financial Statement Quality Assessment

- Red Flags in Financial Reporting

- Earnings Management

- Quality of Earnings Analysis

04 Current Assets 6 topics

1 Cash and Cash Equivalents

- Cash Management

- Bank Reconciliations

- Cash Controls

2 Short-term Investments

- Classification and Valuation

- Recognition of Investment Income

- Disclosures

3 Accounts Receivable

- Recognition and Valuation

- Allowance for Doubtful Accounts

- Aging of Receivables

- Write-offs and Recoveries

4 Notes Receivable

- Initial Recognition

- Interest Calculations

- Discounting Notes Receivable

5 Inventory

- Inventory Cost Flow Assumptions (FIFO, LIFO, Weighted Average)

- Inventory Valuation Methods

- Lower of Cost or Market (Net Realizable Value)

- Inventory Estimation Methods

6 Prepaid Expenses

- Recognition and Amortization

- Types of Prepaid Expenses

05 Long-term Assets 6 topics

1 Property, Plant and Equipment

- Initial Recognition and Cost Components

- Capital vs. Revenue Expenditures

- Subsequent Costs

2 Depreciation

- Straight-Line Method

- Declining Balance Method

- Units of Production Method

- Partial Year Depreciation

3 Asset Impairment

- Indicators of Impairment

- Impairment Testing

- Recording Impairment Losses

4 Asset Disposals

- Sale of Assets

- Trade-ins

- Retirement of Assets

- Calculation of Gain or Loss

5 Intangible Assets

- Types of Intangible Assets

- Initial Recognition

- Amortization

- Impairment Testing

6 Natural Resources

- Depletion Methods

- Environmental Considerations

06 Current Liabilities 6 topics

1 Accounts Payable

- Recognition and Measurement

- Managing Accounts Payable

2 Short-term Notes Payable

- Interest Calculations

- Discounting

3 Unearned Revenue

- Recognition and Adjustments

- Revenue Recognition Principles

4 Accrued Liabilities

- Accrued Salaries and Wages

- Accrued Interest

- Other Accruals

5 Current Portion of Long-term Debt

- Classification

- Measurement

6 Provisions and Contingencies

- Recognition Criteria

- Measurement

- Disclosure Requirements

07 Long-term Liabilities 5 topics

1 Bonds Payable

- Types of Bonds

- Bond Issuance at Par, Premium, and Discount

- Effective Interest Method

- Straight-Line Amortization

- Bond Retirement

2 Long-term Notes Payable

- Initial Recognition

- Interest Calculations

- Installment Payments

3 Leases

- Classification (Finance vs. Operating)

- Lessee Accounting

- Lessor Accounting

- Right-of-Use Assets

- Lease Liabilities

4 Pension and Post-Employment Benefits

- Defined Contribution Plans

- Defined Benefit Plans

- Actuarial Assumptions

- Pension Expense Components

5 Deferred Tax Liabilities

- Temporary Differences

- Permanent Differences

- Calculation and Recognition

08 Stockholders' Equity 7 topics

1 Corporate Form of Organization

- Corporate Characteristics

- Formation of a Corporation

- Corporate Governance Structure

2 Share Capital

- Common Stock

- Preferred Stock

- Treasury Stock

- Stock Issuance

3 Dividends

- Cash Dividends

- Stock Dividends

- Stock Splits

- Dividend Policies

4 Retained Earnings

- Appropriations of Retained Earnings

- Restrictions on Retained Earnings

5 Additional Paid-in Capital

- Sources of Additional Paid-in Capital

- Accounting Treatment

6 Comprehensive Income

- Other Comprehensive Income Items

- Accumulated Other Comprehensive Income

7 Statement of Stockholders' Equity

- Format and Components

- Analysis of Changes

09 Revenue Recognition 3 topics

1 Revenue Recognition Principles

- Five-Step Model under IFRS 15/ASC 606

- Contract Identification

- Performance Obligations

- Transaction Price Determination

2 Special Revenue Recognition Issues

- Multiple-Element Arrangements

- Principal vs. Agent Considerations

- Bill and Hold Arrangements

- Consignment Sales

- Warranties and Product Returns

- Contract Modifications

3 Revenue Disclosures

- Disaggregation of Revenue

- Contract Balances

- Performance Obligations

- Significant Judgments

10 Income and Expenses 5 topics

1 Income Measurement

- Accrual vs. Cash Basis

- Recognition Criteria

2 Expense Recognition

- Matching Principle

- Period Costs vs. Product Costs

3 Income Statement Formats

- Single-Step Income Statement

- Multiple-Step Income Statement

- Comprehensive Income Statement

4 Special Income Statement Items

- Discontinued Operations

- Extraordinary Items

- Changes in Accounting Principles

- Prior Period Adjustments

5 Earnings Per Share

- Basic EPS

- Diluted EPS

- Weighted Average Shares Outstanding

11 Statement of Cash Flows 5 topics

1 Purpose and Importance

- Cash Flow Information Users

- Relationship to Other Financial Statements

2 Cash Flow Classifications

- Operating Activities

- Investing Activities

- Financing Activities

- Non-cash Transactions

3 Preparation Methods

- Direct Method

- Indirect Method

- Working Capital Changes Analysis

4 Special Cash Flow Issues

- Foreign Currency Cash Flows

- Interest and Dividends Classification

- Income Taxes Classification

5 Free Cash Flow Analysis

- Calculation Methods

- Interpretation

- Limitations

12 Accounting for Partnerships 4 topics

1 Partnership Formation

- Partnership Agreement

- Initial Capital Contributions

2 Partnership Operations

- Allocation of Profit and Loss

- Drawings and Salaries

- Financial Statement Preparation

3 Changes in Partnership

- Admission of a New Partner

- Withdrawal of a Partner

- Death of a Partner

4 Partnership Liquidation

- Realization of Assets

- Payment of Liabilities

- Distribution of Remaining Cash

13 Accounting Information Systems 4 topics

1 Manual vs. Computerized Systems

- Components of AIS

- System Documentation

2 Special Journals and Subsidiary Ledgers

- Sales Journal

- Purchases Journal

- Cash Receipts Journal

- Cash Disbursements Journal

- Subsidiary Ledgers for Accounts Receivable and Payable

3 Internal Controls

- Control Environment

- Risk Assessment

- Control Activities

- Information and Communication

- Monitoring Activities

4 Accounting Software

- Selection Criteria

- Implementation Considerations

- Cloud Accounting

14 Accounting for Branches and Departments 3 topics

1 Branch Accounting

- Independent Branch Accounting

- Dependent Branch Accounting

- Inter-branch Transactions

2 Departmental Accounting

- Departmental Income Statements

- Allocation of Common Costs

- Transfer Pricing

3 Segment Reporting

- Operating Segments

- Reportable Segments

- Disclosure Requirements

15 International Financial Reporting 4 topics

1 Comparison of IFRS and GAAP

- Major Differences

- Convergence Efforts

2 Foreign Currency Transactions

- Initial Recognition

- Subsequent Reporting

- Exchange Gains and Losses

3 Translation of Foreign Financial Statements

- Current Rate Method

- Temporal Method

- Translation Adjustments

4 International Financial Statement Analysis

- Country Differences

- Cultural Influences

- Economic Factors

16 Current Developments in Financial Accounting 4 topics

1 Digital Accounting and Blockchain

- Distributed Ledger Technology

- Smart Contracts

- Cryptocurrency Accounting

2 Sustainability Accounting

- Environmental, Social, and Governance (ESG) Reporting

- Integrated Reporting

- Carbon Accounting

3 Big Data and Analytics in Accounting

- Data Visualization

- Predictive Analytics

- Real-time Reporting

4 Artificial Intelligence in Accounting

- Machine Learning Applications

- Automated Data Extraction

- Audit Analytics

Explore More

Financial Accounting

Get it on Google Play