Understand financial markets and investment strategies

196

Sub Topics

613

MCQs

313

MCOs

458

True/False

247

Fill Blanks

89

Rearrange

233

Matching

124

Comprehensions

221

Flashcard Decks

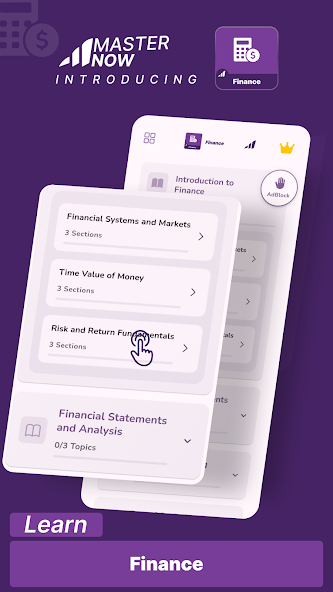

Curriculum

What You'll Learn

01 Introduction to Finance 3 topics

1 Financial Systems and Markets

- Role of Financial Markets

- Financial Intermediaries

- Market Efficiency

2 Time Value of Money

- Simple Interest vs. Compound Interest

- Present Value and Future Value

- Annuities and Perpetuities

3 Risk and Return Fundamentals

- Risk Measurement

- Expected Returns

- Risk-Return Tradeoff

02 Financial Statements and Analysis 3 topics

1 Basic Financial Statements

- Balance Sheet

- Income Statement

- Cash Flow Statement

- Statement of Shareholders' Equity

2 Financial Ratio Analysis

- Profitability Ratios

- Liquidity Ratios

- Solvency Ratios

- Efficiency Ratios

- Market Value Ratios

3 Financial Statement Forecasting

- Pro Forma Statements

- Sustainable Growth Rate

- Financial Planning Models

03 Capital Budgeting 3 topics

1 Investment Decision Criteria

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Payback Period

- Profitability Index

- Modified Internal Rate of Return (MIRR)

2 Cash Flow Estimation

- Incremental Cash Flows

- Working Capital Considerations

- Terminal Value Calculation

3 Capital Budgeting in Practice

- Risk Assessment in Capital Budgeting

- Capital Rationing

- Real Options in Capital Budgeting

04 Cost of Capital and Capital Structure 3 topics

1 Cost of Capital Components

- Cost of Debt

- Cost of Preferred Stock

- Cost of Common Equity

- Weighted Average Cost of Capital (WACC)

2 Capital Structure Theories

- Modigliani-Miller Propositions

- Trade-off Theory

- Pecking Order Theory

- Agency Costs and Capital Structure

3 Optimal Capital Structure

- EBIT-EPS Analysis

- Operating Leverage

- Financial Leverage

- Combined Leverage

05 Working Capital Management 4 topics

1 Cash Management

- Cash Budgeting

- Cash Collection Systems

- Disbursement Control

- Short-term Investment Management

2 Inventory Management

- Economic Order Quantity (EOQ)

- Just-in-Time (JIT) Inventory

- Safety Stock Determination

3 Accounts Receivable Management

- Credit Policy Development

- Collection Policies

- Factoring and Trade Credit

4 Short-term Financing

- Trade Credit

- Bank Loans and Credit Lines

- Commercial Paper

- Inventory Financing

06 Long-term Financing 3 topics

1 Equity Financing

- Common Stock

- Preferred Stock

- Private Equity

- Venture Capital

2 Debt Financing

- Corporate Bonds

- Term Loans

- Lease Financing

- Project Financing

3 Hybrid Securities

- Convertible Securities

- Warrants

- Options and Futures

07 Dividend Policy and Share Repurchases 3 topics

1 Dividend Theories

- Dividend Irrelevance Theory

- Bird-in-Hand Theory

- Tax Preference Theory

- Signaling Theory

2 Dividend Policies

- Stable Dividend Policy

- Constant Payout Ratio

- Residual Dividend Policy

3 Share Repurchases

- Methods of Repurchase

- Repurchase vs. Dividends

- Market Reaction to Repurchases

08 Portfolio Theory and Asset Pricing Models 3 topics

1 Portfolio Theory

- Diversification Benefits

- Efficient Frontier

- Asset Allocation Strategies

2 Capital Asset Pricing Model (CAPM)

- Market Risk Premium

- Beta Calculation and Interpretation

- Security Market Line

3 Multifactor Models

- Arbitrage Pricing Theory (APT)

- Fama-French Three-Factor Model

- Carhart Four-Factor Model

09 Fixed Income Securities 3 topics

1 Bond Fundamentals

- Bond Pricing

- Yield Measures

- Duration and Convexity

2 Bond Markets and Instruments

- Government Bonds

- Municipal Bonds

- Corporate Bonds

- Mortgage-Backed Securities

3 Fixed Income Portfolio Management

- Immunization Strategies

- Active vs. Passive Management

- Yield Curve Strategies

10 Derivatives 4 topics

1 Options

- Call and Put Options

- Option Pricing Models

- Option Greeks

- Option Strategies

2 Futures and Forwards

- Contract Specifications

- Pricing Mechanics

- Hedging Strategies

- Basis Risk

3 Swaps

- Interest Rate Swaps

- Currency Swaps

- Credit Default Swaps

- Total Return Swaps

4 Credit Derivatives

- Credit Default Swaps

- Collateralized Debt Obligations

- Credit-Linked Notes

11 Financial Risk Management 4 topics

1 Market Risk

- Value at Risk (VaR)

- Stress Testing

- Scenario Analysis

2 Credit Risk

- Credit Scoring Models

- Expected and Unexpected Loss

- Credit Risk Mitigation

3 Operational Risk

- Risk Identification

- Risk Assessment

- Risk Control and Mitigation

4 Integrated Risk Management

- Enterprise Risk Management (ERM)

- Risk Governance

- Economic Capital Allocation

12 International Finance 3 topics

1 Foreign Exchange Markets

- Exchange Rate Determination

- Foreign Exchange Risk

- Hedging Strategies

2 International Capital Budgeting

- Political Risk Assessment

- Cash Flow Adjustments

- International Cost of Capital

3 International Corporate Finance

- International Tax Planning

- Transfer Pricing

- International Working Capital Management

13 Mergers, Acquisitions, and Corporate Restructuring 3 topics

1 Mergers and Acquisitions

- Types of Mergers

- Valuation Methods

- Synergy Estimation

- Deal Structuring

2 Corporate Restructuring

- Divestitures

- Spin-offs

- Carve-outs

- Split-ups

3 Leveraged Buyouts

- LBO Structure

- Sources of Value

- Exit Strategies

- LBO Financial Analysis

14 Financial Planning and Forecasting 3 topics

1 Personal Financial Planning

- Investment Planning

- Retirement Planning

- Education Planning

- Estate Planning

2 Corporate Financial Planning

- Long-term Strategic Planning

- Annual Budgeting Process

- Scenario Planning

- Sensitivity Analysis

3 Financial Forecasting Techniques

- Time Series Analysis

- Regression Analysis

- Simulation Methods

- Judgmental Forecasting

15 Behavioral Finance 3 topics

1 Market Anomalies

- Calendar Effects

- Size Effect

- Value vs. Growth

- Momentum Effect

2 Investor Biases

- Overconfidence

- Herding Behavior

- Loss Aversion

- Mental Accounting

3 Limits to Arbitrage

- Implementation Costs

- Fundamental Risk

- Noise Trader Risk

- Market Inefficiency Persistence

16 Financial Technology and Innovation 4 topics

1 Digital Banking

- Online Banking Platforms

- Mobile Payment Systems

- Digital Wallets

2 Financial Data Analytics

- Big Data in Finance

- Machine Learning Applications

- Algorithmic Trading

3 Blockchain and Cryptocurrencies

- Distributed Ledger Technology

- Smart Contracts

- Cryptocurrency Markets

- Tokenization of Assets

4 Regulatory Technology (RegTech)

- Compliance Automation

- Regulatory Reporting

- Risk Data Aggregation

17 Sustainable and Responsible Finance 4 topics

1 Environmental, Social, and Governance (ESG)

- ESG Metrics and Reporting

- ESG Integration in Investment

- Impact Measurement

2 Green Finance

- Green Bonds

- Climate Finance

- Carbon Markets

3 Social Finance

- Social Impact Bonds

- Microfinance

- Community Development Finance

4 Responsible Investment Strategies

- Negative Screening

- Positive Screening

- Thematic Investing

- Shareholder Engagement

Explore More

Finance

Get it on Google Play