Master cryptocurrency trading strategies and analysis

153

Sub Topics

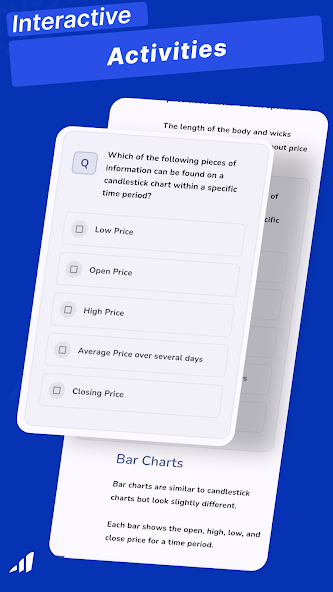

436

MCQs

216

MCOs

352

True/False

203

Fill Blanks

64

Rearrange

164

Matching

96

Comprehensions

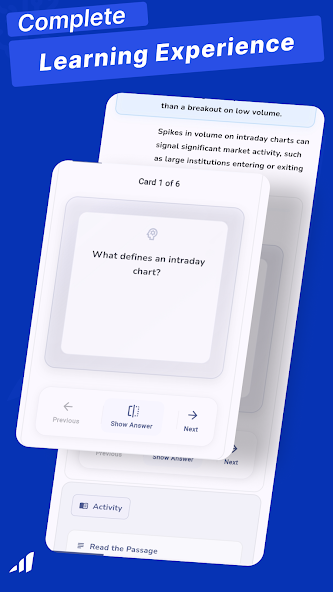

160

Flashcard Decks

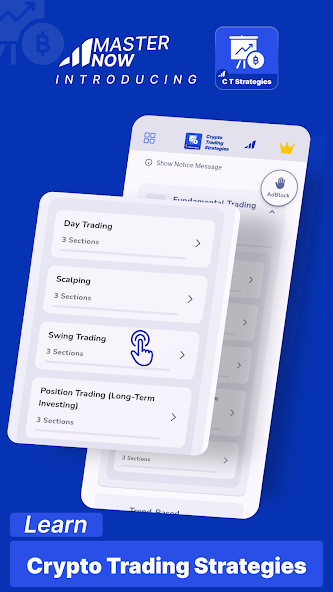

Curriculum

What You'll Learn

01 Fundamental Trading Approaches 5 topics

1 Day Trading

- Intraday Chart Analysis Techniques

- Volume Profile for Day Traders

- Managing Intraday Volatility

2 Scalping

- High-Frequency Trading Setups

- Bid-Ask Spread Exploitation

- Order Book Scalping Techniques

3 Swing Trading

- Identifying Optimal Swing Entry Points

- Hold Duration Optimization

- Combining Technical and Fundamental Triggers

4 Position Trading (Long-Term Investing)

- Fundamental Analysis for Long Positions

- Entry Timing for Position Traders

- Position Sizing for Long-Term Holdings

5 Range Trading

- Support and Resistance Identification

- Range Bound Market Detection

- Channel Trading Implementation

02 Trend-Based Strategies 5 topics

1 Trend Following

- Moving Average Systems

- ADX and Trend Strength Indicators

- Pullback Entry Tactics

2 Momentum Trading

- RSI-Based Momentum Systems

- MACD Momentum Strategies

- Volume-Confirmed Momentum

3 Breakout Trading

- High-Volume Breakout Detection

- False Breakout Filtering

- Continuation Breakout Patterns

4 Moving Average Crossover Strategy

- Golden Cross and Death Cross Trading

- Triple Moving Average Systems

- Adaptive Moving Average Strategies

5 MACD Divergence Trading

- Bullish and Bearish Divergence Identification

- Hidden Divergence Techniques

- Multiple Timeframe Divergence Confirmation

03 Reversal and Counter-Trend Strategies 4 topics

1 Reversal Trading

- Candlestick Reversal Patterns

- Overbought/Oversold Indicators for Reversals

- Volume Spike Reversal Signals

2 Contrarian Trading

- Market Sentiment Indicators

- Crowd Psychology Analysis

- Risk Management for Contrarian Positions

3 Mean Reversion Trading

- Statistical Mean Calculation Methods

- Bollinger Band Mean Reversion

- RSI-Based Mean Reversion Systems

4 Support and Resistance Flip Trading

- S/R Flipping Confirmation Techniques

- Time-Based S/R Flip Analysis

- Volume Confirmation for S/R Flips

04 Technical Indicator-Based Strategies 5 topics

1 Fibonacci Retracement Trading

- Identifying High-Probability Fibonacci Levels

- Combining Fibonacci with Support/Resistance

- Fibonacci Extension Targets

2 Ichimoku Cloud Trading

- Cloud Breakout Strategies

- Tenkan/Kijun Cross Systems

- Multi-Timeframe Ichimoku Analysis

3 Bollinger Bands Squeeze

- Volatility Contraction Identification

- Post-Squeeze Breakout Trading

- Volume Confirmation for Squeezes

4 VWAP (Volume-Weighted Average Price) Strategy

- VWAP Reversion Trading

- VWAP Trend Continuation

- Multi-Timeframe VWAP Applications

5 Order Book Trading

- Identifying Liquidity Zones

- Order Book Imbalance Trading

- Spoofing Detection Techniques

05 Pairs and Correlation Strategies 4 topics

1 Pair Trading

- Correlation Analysis for Pair Selection

- Spread Calculation and Entry Triggers

- Statistical Arbitrage for Crypto Pairs

2 Grid Trading

- Basic Grid Setup and Calculation

- Dynamic Grid Adjustment Techniques

- Grid Trading for Sideways Markets

3 Grid Trading Bots (Advanced Version)

- AI-Enhanced Grid Parameters

- Multi-Asset Grid Systems

- Risk Management for Automated Grids

4 Grid Arbitrage

- Correlation-Based Grid Arbitrage

- Cross-Pair Grid Implementation

- Risk Control in Grid Arbitrage

06 Arbitrage and Market Inefficiency Strategies 5 topics

1 Arbitrage Trading

- Exchange-to-Exchange Arbitrage

- Execution Speed Optimization

- Fee Management in Arbitrage

2 Triangular Arbitrage

- Three-Pair Arbitrage Calculation

- Automated Triangular Opportunity Detection

- Risk Controls for Triangular Arbitrage

3 Funding Rate Arbitrage

- Funding Rate Analysis

- Cross-Exchange Hedged Positions

- Cash-and-Carry Arbitrage

4 Cross-Exchange Leverage Arbitrage

- Margin Management Techniques

- Liquidation Risk Mitigation

- Interest Rate Optimization

5 Front-Running

- MEV Extraction Techniques

- DeFi Transaction Monitoring

- Ethical and Legal Considerations

07 DeFi-Specific Trading Strategies 4 topics

1 Liquidity Pool (LP) Trading

- Pool Selection Criteria

- Impermanent Loss Calculation

- LP Position Management

2 Flash Loan Arbitrage

- Flash Loan Protocol Integration

- Cross-Protocol Arbitrage Execution

- Smart Contract Implementation

3 Staking and Yield Farming

- APY/APR Analysis and Comparison

- Compounding Optimization

- Risk-Adjusted Returns Calculation

4 Reinvestment Strategy

- Compound Interest Models

- Automated Reinvestment Systems

- Tax-Efficient Reinvestment

08 Derivatives and Leveraged Trading 4 topics

1 Options Trading (Derivatives)

- Call and Put Options Basics

- Options Strategies for Volatile Markets

- Options Greeks Analysis

2 Perpetual Futures Trading

- Funding Rate Mechanics

- Liquidation Risk Management

- Leverage Optimization

3 Hedging

- Portfolio Hedging Techniques

- Delta Hedging Implementation

- Options-Based Hedging Strategies

4 Gamma Scalping (Options Strategy)

- Delta-Neutral Gamma Scalping

- Volatility Regime Adaptations

- Options Chain Analysis

09 Systematic and Automated Trading 4 topics

1 High-Frequency Trading (HFT)

- Infrastructure Requirements

- Latency Optimization

- HFT Algorithm Development

2 Copy Trading

- Trader Selection Criteria

- Risk Management in Copy Trading

- Performance Tracking Systems

3 Dollar-Cost Averaging (DCA)

- Schedule Optimization

- Dynamic DCA Adjustments

- DCA for Bear Markets

4 Rebalancing Strategy (Portfolio Management)

- Optimal Rebalancing Frequency

- Threshold-Based Rebalancing

- Tax-Efficient Rebalancing

10 Alternative Analysis Strategies 4 topics

1 News-Based Trading

- Event Classification and Impact Analysis

- News Alert Systems

- Pre and Post-Announcement Trading

2 Social Sentiment Trading

- Social Media Data Collection

- Sentiment Analysis Algorithms

- Sentiment-Based Entry/Exit Signals

3 On-Chain Analysis Strategy

- Whale Wallet Monitoring

- Network Activity Metrics

- Exchange Flow Analysis

4 Tokenomics-Based Trading

- Supply Emission Analysis

- Token Utility Valuation

- Governance Token Analysis

11 NFT and Specialized Markets 3 topics

1 NFT Flipping

- Collection Research Methodology

- Rarity and Attribute Analysis

- NFT Market Cycle Trading

2 NFT Floor Price Strategies

- Floor Sweeping Techniques

- Collection Demand Analysis

- Cross-Collection Arbitrage

3 Metaverse Asset Trading

- Virtual Land Valuation

- In-Game Item Trading

- Metaverse Token Correlation

12 Risk Management and Strategy Integration 4 topics

1 Portfolio-Level Risk Management

- Position Sizing Frameworks

- Correlation-Based Diversification

- Drawdown Management

2 Strategy Combining Techniques

- Complementary Strategy Pairing

- Market Regime Strategy Rotation

- Multi-Strategy Performance Tracking

3 Strategy Backtesting and Validation

- Historical Data Testing Methodologies

- Out-of-Sample Testing

- Monte Carlo Simulation

4 Performance Monitoring and Adjustments

- Key Performance Metrics

- Strategy Decay Detection

- Continuous Improvement Processes

Explore More

Crypto Trading Strategies

Get it on Google Play